Everything about Clark Wealth Partners

Some Known Incorrect Statements About Clark Wealth Partners

Table of ContentsAn Unbiased View of Clark Wealth PartnersThe Definitive Guide to Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersClark Wealth Partners Fundamentals Explained10 Easy Facts About Clark Wealth Partners DescribedThings about Clark Wealth Partners

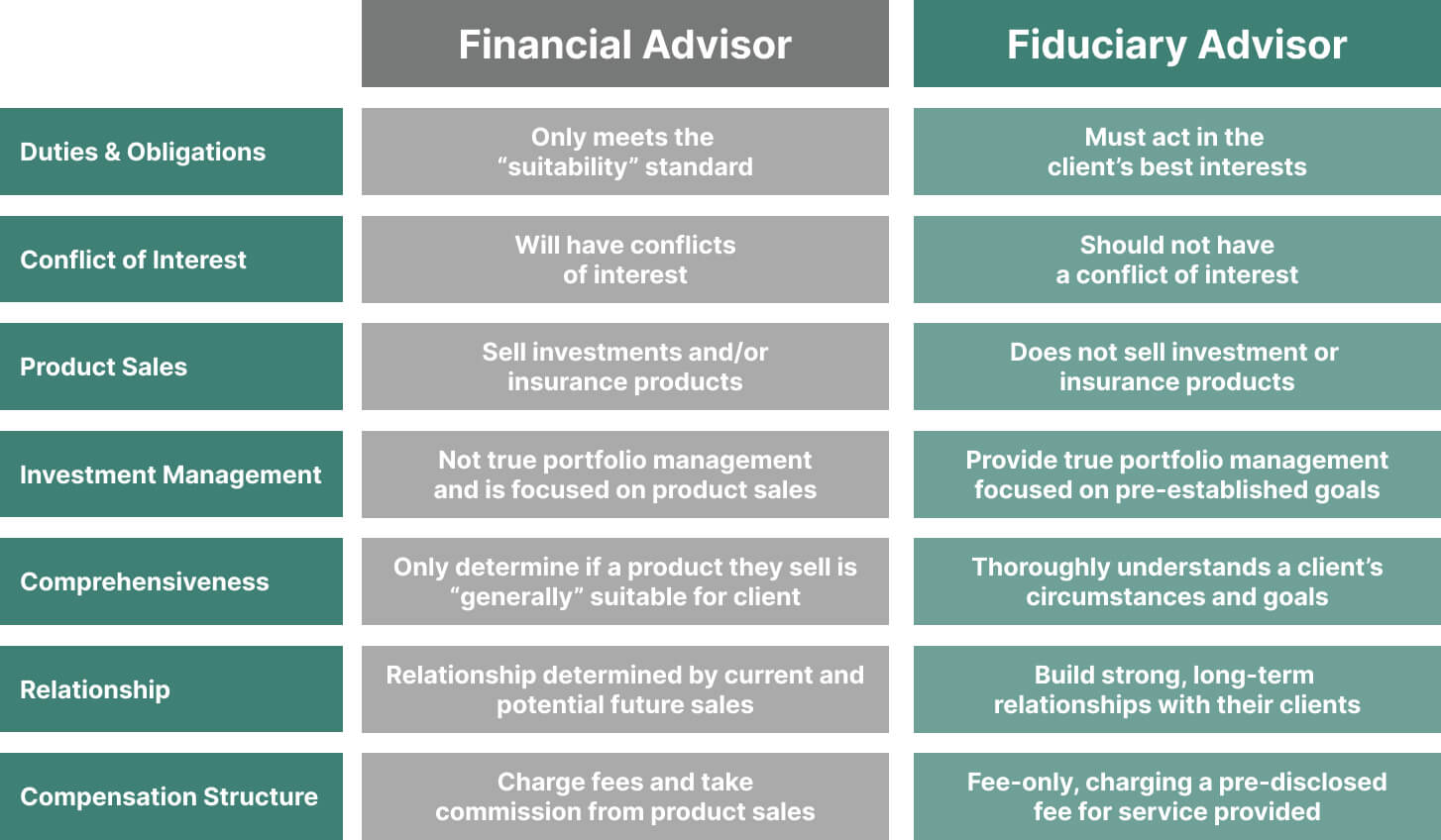

These are specialists who supply investment advice and are signed up with the SEC or their state's safeties regulator. NSSAs can assist senior citizens choose regarding their Social Safety and security advantages. Financial consultants can likewise specialize, such as in pupil car loans, elderly demands, tax obligations, insurance policy and other facets of your financial resources. The certifications required for these specializeds can vary.Not constantly. Fiduciaries are lawfully required to act in their customer's benefits and to maintain their money and residential or commercial property different from various other properties they manage. Only monetary consultants whose designation calls for a fiduciary dutylike licensed economic organizers, for instancecan claim the exact same. This distinction also means that fiduciary and economic consultant charge frameworks differ also.

The Clark Wealth Partners PDFs

If they are fee-only, they're most likely to be a fiduciary. If they're commission-only or fee-based (meaning they're paid using a combination of costs and commissions), they may not be. Several qualifications and designations need a fiduciary obligation. You can check to see if the specialist is registered with the SEC.

Picking a fiduciary will ensure you aren't steered towards particular investments because of the payment they offer - st louis wealth management firms. With great deals of cash on the line, you might want an economic professional that is legitimately bound to make use of those funds thoroughly and just in your benefits. Non-fiduciaries may recommend investment products that are best for their wallets and not your investing objectives

What Does Clark Wealth Partners Do?

Find out more now on just how to keep your life and savings in balance. Rise in financial savings the ordinary family saw that dealt with an economic consultant for 15 years or more compared to a comparable household without an economic consultant. Source: Claude Montmarquette & Alexandre Prud'homme, 2020. "Extra on the Worth of Financial Advisors," CIRANO Job Information 2020rp-04, CIRANO.

Financial advice can be valuable at transforming points in your life. When you fulfill with an advisor for the initial time, function out what you desire to obtain from the recommendations.

Excitement About Clark Wealth Partners

When you have actually agreed to go ahead, your financial advisor will prepare a monetary plan for you. You need to always feel comfortable with your consultant and their recommendations.

Insist that you are alerted of all purchases, which you obtain all communication relevant to the account. Your advisor might recommend a managed optional account (MDA) as a means of handling your investments. This entails signing an arrangement (MDA agreement) so they can buy or market investments without needing to contact you.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Prior to you purchase an MDA, contrast the benefits to the prices and risks. To protect your cash: Do not give your adviser power of attorney. Never ever sign an empty file. Place a time frame on any type of authority you offer to acquire and offer investments in your place. Firmly insist all document concerning your investments are sent to you, not just your adviser.

This might take place try this out throughout the conference or electronically. When you enter or renew the ongoing charge plan with your advisor, they must explain exactly how to end your relationship with them. If you're moving to a brand-new consultant, you'll need to organize to move your financial records to them. If you need assistance, ask your advisor to discuss the procedure.

will retire over the next years. To load their footwear, the nation will require even more than 100,000 brand-new financial experts to go into the sector. In their everyday job, financial experts manage both technological and imaginative tasks. U.S. Information and Globe Report ranked the function amongst the leading 20 Best Business Jobs.

Clark Wealth Partners for Beginners

Helping individuals accomplish their financial objectives is a financial expert's primary feature. They are also a tiny business proprietor, and a portion of their time is devoted to handling their branch office. As the leader of their technique, Edward Jones economic experts need the leadership skills to employ and handle staff, in addition to business acumen to produce and implement a company approach.

Spending is not a "set it and forget it" task.

Financial experts must arrange time each week to meet brand-new people and catch up with the individuals in their round. The economic services market is greatly controlled, and policies change often - https://fliphtml5.com/homepage/clrkwlthprtnr/blanca-rush/. Many independent monetary consultants invest one to two hours a day on compliance tasks. Edward Jones economic experts are fortunate the home office does the heavy lifting for them.

The 9-Second Trick For Clark Wealth Partners

Continuing education is a necessary component of maintaining a monetary expert license (financial advisors illinois). Edward Jones monetary experts are urged to seek extra training to expand their understanding and abilities. Dedication to education secured Edward Jones the No. 17 spot on the 2024 Training APEX Awards listing by Training publication. It's additionally an excellent idea for financial advisors to go to industry meetings.